Services

GFM Investments LLC

Until Your Next Paycheck

GFM Investments, LLC connects borrowers with private money lenders. While we’re not direct lenders, we work closely with a network of private financiers who fund deals using their own capital. Our personalized approach ensures each client is matched with the right lender for their needs—no upfront or hidden fees, ever.

Trust.

Integrity.

Precision.

Excellence.

Real Estate Investments Loans

GFM Investments, LLC connects borrowers with private money lenders. While we’re not direct lenders, we work closely with a network of private financiers who fund deals using their own capital. Our personalized approach ensures each client is matched with the right lender for their needs—no upfront or hidden fees, ever.

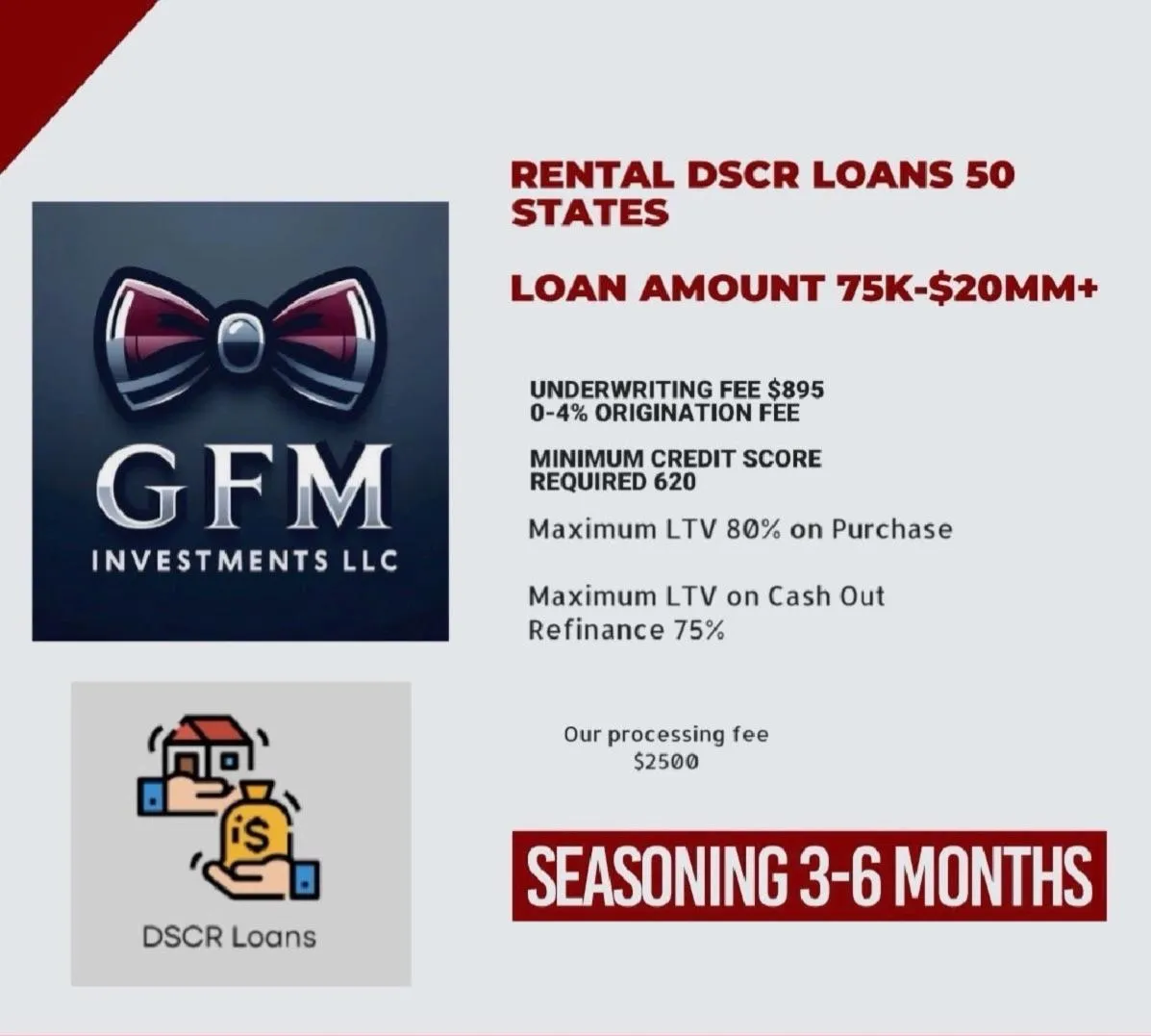

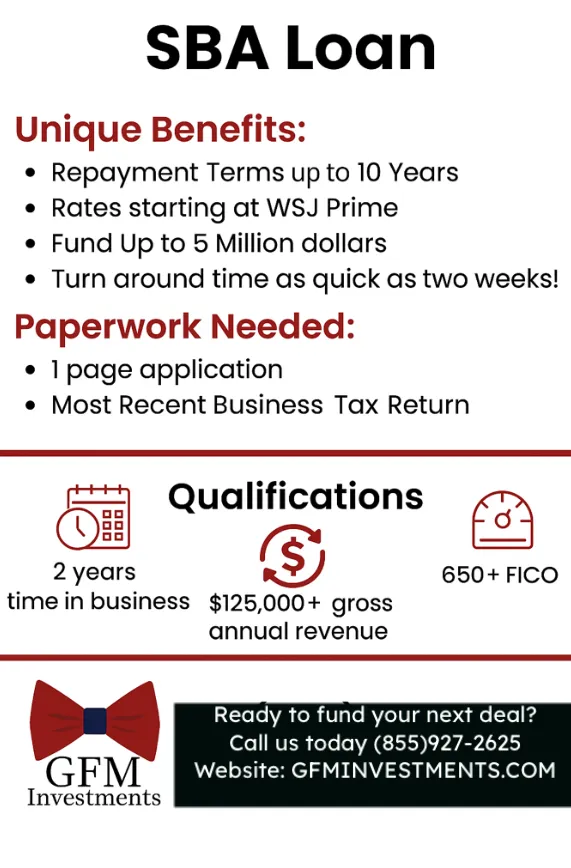

Rental DSCR Loans 50 States

Loan Amount $75K-$20MM+

$895-$2999 underwriting fee

0-4% origination fee

Minimum Credit 620

Maximum LTV 80% on Purchase

Maximum LTV on Cash Out Refinance 75% Seasoning 3-6 months

Our processing fee $2500 (fee is built into the loan) THIS IS NOT UPFRONT

855- 927- 2625

FIX & FLIP LOANS 46 States

Loan Amount $50K-$50MM+

Origination fees 0.75% -4% 85%-90% of the Purchase (credit dependent)

100% of the rehab

Max 70% ARV -0-4 Experience

Max 75% ARV--Pro's 5+ in the last 180 days

Minimum credit score 620

Our processing fee $2500 (fee is built into the loan) THIS IS NOT UPFRONT

855- 927- 2625

Fix & Flip Loans

No minimum Loan size in 22 states (map attached) This is NOT for foreign investors 90% of the Purchase 100% of the Rehab Lender application fee $495 $895 underwriting fee 4% origination fee (or $2000 whichever is greater) Minimum Credit 600 Our processing fee $2500 (fee is built into the loan) THIS IS NOT UPFRONT

Real Estate Investments Loans

GFM Investments, LLC connects borrowers with private money lenders. While we’re not direct lenders, we work closely with a network of private financiers who fund deals using their own capital. Our personalized approach ensures each client is matched with the right lender for their needs—no upfront or hidden fees, ever.

Ground Up Construction

Ground Up Construction

Loan Amount $100-$50MM+ Origination fees 4% 85%-90% of the Purchase (credit dependent) 85% to 100% of the rehab Max 70% ARV -0-4 Experience Max 75% ARV--Pro's 5+ in the last 180 days Minimum credit score 620 Our processing fee $2500 (fee is built into the loan) THIS IS NOT UPFRONT

Residential Hard Money Loans

Residential Hard money loans are designed for investment properties only. Popular with Real Estate Investors for Fix & Flips. These are business purpose loans which include: loans to purchase, repair or improve real property for use in the Borrower’s business — to acquire, improve or maintain certain non-owner occupied rental property, to purchase, improve or repair equipment, machinery, fixtures or furnishings used in Borrower’s business, for operating capital (e.g. Employee salaries) or to purchase or pay for business inventory; supplies, rent, taxes, insurance, and other related expenses — or to pay off, refinance or consolidate business debt.

The most popular of these types of loans are Fix & Flip . We have programs that will provide you up to 100% of the purchase price and 100% of the costs to rehab the property. When you realize the increase in return of investment vs buying all cash. Contact us at (855) 927-2625

Turning Vision Into Reality

Precision in Every Transaction

Residential Hard Money Loans

Multifamily, Investment, and Commercial Bridge Loans provide competitive rates for buildings and borrowers in need of short-term financing for 12 to 36-months. Bridge loans, also known as interim financing, gap financing or swing loans, "bridge the gap" during times when permanent financing is needed but is not yet available to the borrower. Both corporations and individuals use bridge loans, and lenders can customize these loans for many different situations. Businesses and real estate investors turn to bridge loans when they are waiting for long-term financing and need money to cover expenses in the interim or cash to purchase, refinance, or rehab real estate.

For example, a real estate investor may have a commercial building that is only 50-60% leased up and the current net operating income does not support the debt service coverage ratio required by lenders offering permanent financing The investor may use a bridge loan during the lease-up period, then refinance into a permanent loan or sell the property.

Bridge Loan Overview

A real estate investor may own a commercial building that is only 50–60% leased, meaning the current Net Operating Income (NOI) doesn't meet the Debt Service Coverage Ratio (DSCR) required for traditional permanent financing.

In such cases, the investor can use a bridge loan during the lease-up or stabilization period, then either refinance into a permanent loan or sell the property once the income supports long-term financing.

Loan Details

Property Types:

Multifamily (5+ units), Manufactured Home Communities, Office, Retail, Industrial, R&D Flex, Self-Storage, Hotels/Motels, and more.

Loan Size:

$100,000 – $100,000,000+

Term & Structure:

1–3 Year Terms | Fixed & Variable Rates | Interest-Only | Asset-Based

Max Loan-to-Value (LTV):

Multifamily (5+ Units): Up to 75%

Commercial: Up to 70%

Debt Service Coverage Ratio (DSCR):

Varies by deal

Closing Timeframe:

7 to 21 Days

FIX & FLIP PROGRAM DETAILS

We offer the market’s most powerful financing solutions with speed, competitive terms, lower rates, and higher LTVs. SoCal Mortgage Lender leads the way as your reliable fix and flip funding source. Giving you the peace of mind to focus on your rehab property investment and realize its true profit potential. Take advantage of our Fix & Flip programs that can provide you up to 100% of the purchase price and 100% of the rehab.

Another feature that might interest you. We offer on some of our Fix & Flip loans no interest charged on rehab funds set aside that haven't been drawn yet. The amount of money you can keep in your pocket in savings with this feature alone, should have you wanting to call us.

Who Is this For? This for real estate investors looking to increase their ROI and/or, increase the amount of properties you can do at one time. We are flexible to custom make a loan based on your business model whether you want us to fund based on your purchase price, future value, or just pull cash out on any type of real estate

Detailed Property Assessments

Our thorough inspections cover every inch of your commercial property. From foundation to roof, we ensure no detail is overlooked, giving you an accurate snapshot of your investment’s condition.

Risk Mitigation

With our expert analysis, we identify potential risks and provide actionable recommendations, allowing you to address issues before they impact your investment’s value.

Transparent Reporting

Our inspection reports are designed for clarity. With detailed photos, concise descriptions, and actionable advice, you’ll have all the information you need to make informed decisions.

Ongoing Support & Guidance

From the initial inspection to long-term maintenance advice, our team is dedicated to supporting you throughout your property’s lifecycle, ensuring it remains in top condition.

Our Testimonial

What Our Clients Say About Us

I was completely unsure how to secure funding, especially with my credit history. But this team guided me through every step of the process and got me approved faster than I ever expected. They delivered exactly what they promised — even when I thought I didn’t qualify

– John Doe, Commercial Property Investor

Unlock the Full Potential of Your Real Estate Journey

We specialize in delivering comprehensive commercial property inspections that help you understand the true condition of your investment. Our thorough assessments are designed to identify any structural, safety, or compliance issues. Using advanced tools and industry-leading expertise

GFM Investments, LLC connects borrowers with private money lenders. While we’re not direct lenders, we work closely with a network of private financiers who fund deals using their own capital. Our personalized approach ensures each client is matched with the right lender for their needs—no upfront or hidden fees, ever.

Quick links

Services

© Los Angeles, California. 2025. All Rights Reserved.